Business Assurance: Evolution and What It Means to CSPs

Evolution of Revenue Assurance into Business Assurance

By now, it is almost common knowledge that the telecom world has moved well beyond the conventional idea of Revenue Assurance (RA). But what were the factors which led to this?

Conventionally, telecom Revenue Assurance used to be a non-real-time, post-facto, and reactive method of finding revenue leakages amongst the data about events that have already happened.

To understand this further, conventional Revenue Assurance predominantly revolved around reconciling events between the source of origination to the final culmination point – billing and actioning on the outcomes in the form of mismatches.

While this methodology was leveraged on a reactive basis for ages, with time and the evolution of sophisticated data transfer technologies, we could derive more capabilities around real-time revenue assurance, thereby mitigating the leakage run-time to the least possible extent.

However, the effective yield from the RA functionalities mentioned above started to diminish and became increasingly insignificant due to the below factors:

- Stiff competition between operators fighting for supremacy on subscriber acquisition meant that the prices of conventional telecom services were constantly reduced.

- Consequent to the above, the average revenue per user dropped, which meant that even if the findings from evolved revenue assurance practices were significant, they did not translate to the same level of significance in dollar value.

Naturally, this set the ball rolling for the evolution of conventional Revenue Assurance into Business assurance.

What does this really mean?

Fundamentally, Revenue Assurance (RA) revolves around identifying anomalies across the operator’s business. These anomalies might be systemic, human, process-related, or stemming from a lack of coordination, either technical or intra-departmental, in an operator ecosystem.

This means that while conventionally, RA revolved around usage, mainly source (switch) to destination (bill) reconciliations, it can be expanded to cover other more expansive business areas. From detecting leakages in usage revenue, it can expand to assure aspects of product margins, customer satisfaction, rating, contract management, etc., to name a few.

Another aspect to consider in this context is the already available, clean, normalized, ready-to-use and extremely useful data that RA systems have at their disposal, out of which only a sub-set has been tapped into. This has ensured the evolution can be more seamless and natural.

Collectively, by virtue of the above factors and more, Revenue assurance can and has evolved to what we call it today – Business Assurance.

The definition of Business Assurance and what it means to CSPs:

As clichéd as it is, we all know the Communication Service Providers (CSPs) have transformed dramatically in terms of the services they offer to their customers to being Digital Service Providers (DSPs). This, consequently, means that they have to address new, dynamic, and constantly evolving risks and challenges. As a result, they would have to redefine and rejig their existing resources to equip them with the skills required for a more comprehensive Business Assurance view across the organization.

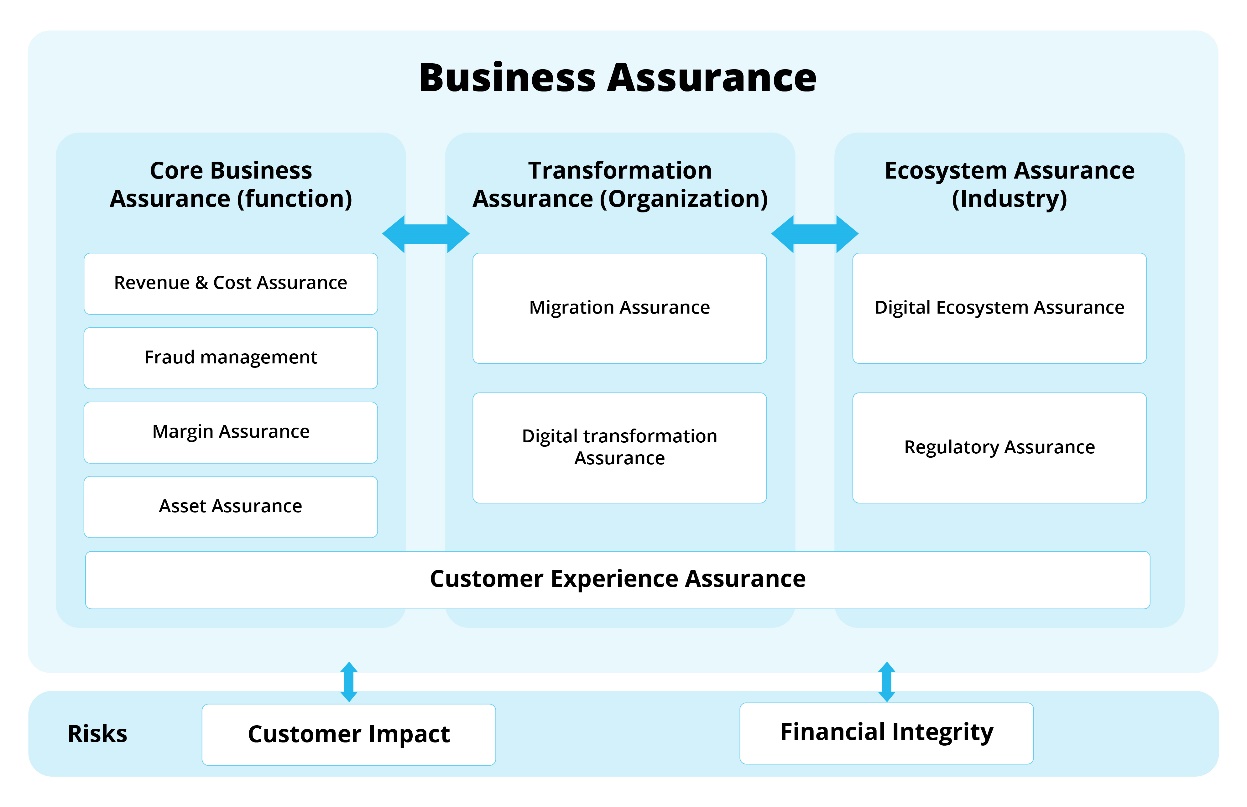

Business Assurance amalgamates conventional assurance and risk areas into a data-driven, proactive, all-encompassing framework to protect financial integrity while ensuring seamless customer experience and business value.

In addition to the above, Business assurance would constitute a wide array of areas – Product & Offer Management, Customer Management, Order Management & Provisioning, Network Management, Rating & Billing Assurance, Finance & Accounting, etc. It would be imperative to say that all these areas need to be supported by sophisticated technologies around data analytics, artificial intelligence, and blockchain.

While the above BA views are relatively generic, it seldom works in a one-size-fits-all approach. Hence, it is imperative that each organization refines the relevance and extent of the BA scope in their particular environment basis the business needs.

Webinar on Business Assurance in 5G:

5 controls you cannot do without