Why Artificial Intelligence Powered Fraud Management

Artificial Intelligence (AI) is not new and it has been around for decades. However, with the advent of big data and distributed computing that is available today, it is possible to realize the true potential of AI. From what started as an interesting story line in SCI-FI movies to programs like Alpha-Go which has been beating humans, AI has been evolving. AI also has branched out into multiple sub categories such as Machine Learning, Deep Learning, Re-enforcement learning etc.

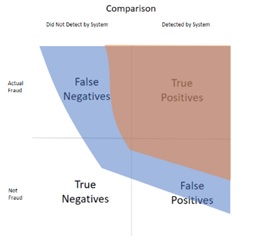

An effective Fraud Management (FM) strategy includes 3 important pillars: Detect, Investigate & Protect. We believe AI can positively influence all the 3 pillars of fraud management, from reducing false positives to helping in mining root cause analysis to creating enhanced customer experience in protection.

In this post I would like to look at the starting pillar of the Fraud Management strategy – “Detection” and look at AI’s influence in this very important step. A traditional approach to Fraud detection has been through Rule Engines which could be:

- If-Else Conditions

- Thresholds

- Expressions

- Evaluating Data Patterns

These are widely known as deterministic solutions where an event triggers an action. The biggest pros and cons with this approach is that human intervention is needed to feed the logic.

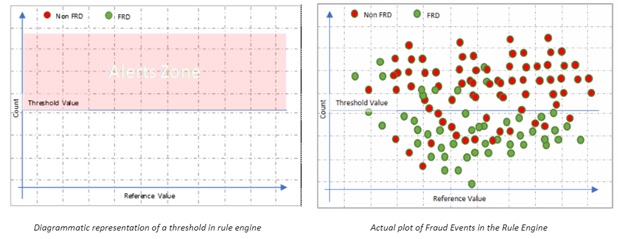

For eg: for a threshold based detection humans have to feed the rule engine that count of records above a certain threshold is suspicious.

Following diagrams shows how this looks like

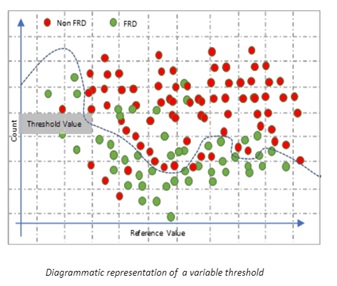

After looking at the diagram above an important question arises, should this threshold value be a straight line or can it bend based on how data behaves. Now there are ways for rule engine to behave like mentioned in the diagram,

for eg, instead of having a single rule lets have multiple rules

- Per Customer Category

- Per Destination

- Per Age of Customers

And multiply that with other dimensions in data which are

- Phone Number

- Caller Number

- Called Number

- Country Code

And multiple that with other set of measures per dimensions

- Count

- Duration

- Value

And throw an additional billion volumes at the datasets

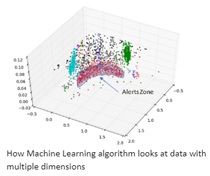

But what they wanted or dreamt was this

Now I am not saying FM teams are not skilled enough to fly, but a fraud team in a modern Digital Service provider should be more focused on other important factors.

This approach thereby helps in achieving multiple KPI’s of fraud management teams there by increasing efficiency.

- Higher Accuracy – Because AI can learn and adapt to Business scenarios faster, AI can significantly increase True Positive ratio

- Reduced time to detect – How fast a fraud event can be detected

- Self-Learning – How over a period changing business scenarios and seasonality in data can be adopted to Fraud detection

- Fraud Intelligence– How customer or any other entity behaviors can be learnt and categorized for better fraud detection

- Proactiveness – Ability to mine for unknown patterns not seen in the data earlier

To learn more about how AI/ML would transform the Fraud Management Systems, Join us on our two-part series of “AI Master Class for Fraud Management” to familiarize yourself with AI/ML through a live demo.