Blockchain

Partner Ecosystem Management

Jan 15, 2020

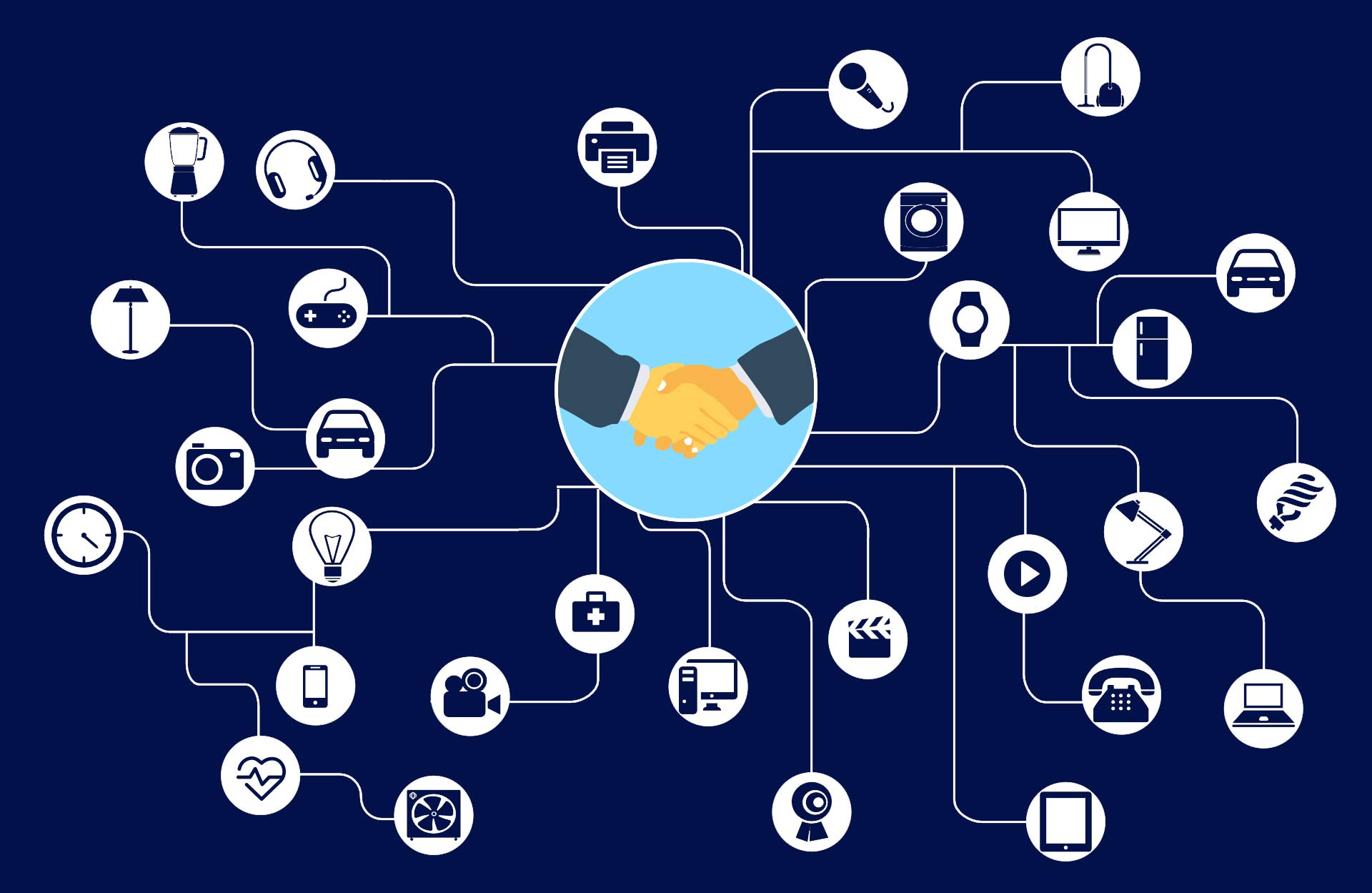

Partner Ecosystem Management

Dec 16, 2019

Digital

Partner Ecosystem Management

Digital

Partner Settlement

Partner Settlement

Network Analytics

Mar 15, 2018

Capex Optimisation