Growing Beyond Revenue Assurance: The Rise of Business Assurance

Traditionally revenue assurance functions have been monitoring revenue streams from switch to billing, with the primary goal of detecting leakages usually with a latency of more than 24 hours. With the success of the revenue assurance function itself being measured on the value of leakage being identified, larger the finding, greater the success of the revenue assurance function. This being a model that has been working since the age of 2G services, the entire RA functions built on the foundation of identifying leakages.

In the rare event of having a near-flawless service allocation and metering of a revenue stream, the RA function is forced to expand controls to newer areas & technologies in the quest to find the elusive leakage. This quest of validating the purpose of the RA function’s existence begins and ends year on year proving to be a major challenge with decreasing ARPUs & cost per call/transaction.

That brings us to an important question. Can leakage be the only measurement for a RA function?

German car manufacturers employ a method called FMEA (Failure Method Effective Analysis) that enables them to reach a near-zero percentage of failures from design to manufacturing as one minor failure can at times be catastrophic to an end-user or lead to customer dissatisfaction. Thereby the end goal being that the absence of failures is a direct correlation to the success of risk mitigation programs, an approach that is contrary to traditional RA practices.

In RA we are now evolving towards a similar path. While leakage can be one parameter indicating failure of a process, the others are revenue & cost monitoring, margin management, enablement of CXOs and finally customer fulfillment that provides the base for competitive advantage.

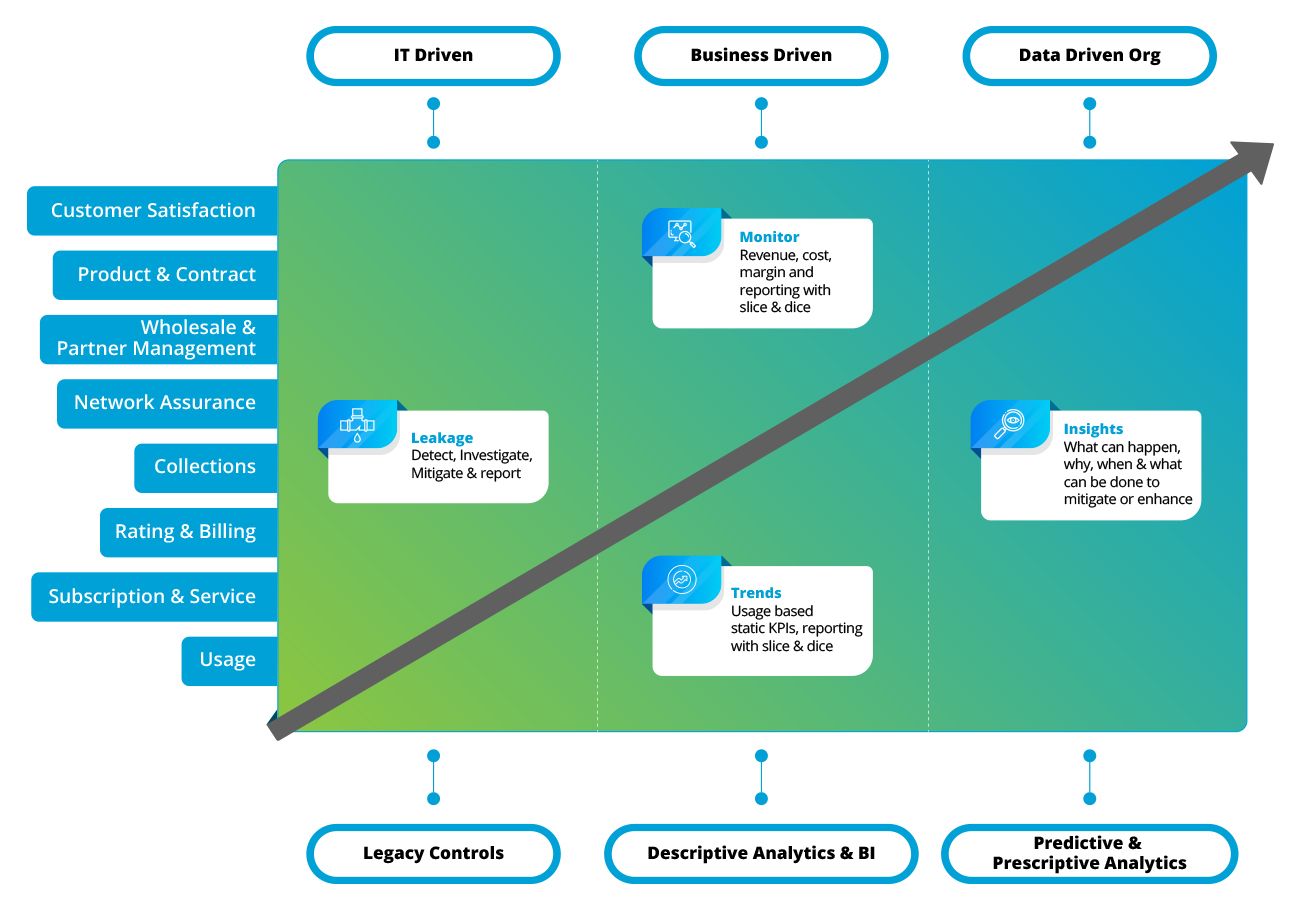

For example, as indicated in the graph on the above.

For example, as indicated in the graph on the above.

Moving purely along the Y axis only increases the count of controls for an RA function with the sole purpose of finding leakage

While moving purely along the X axis brings in minimal coverage that does not protect all services nor enables all functions of the business

A linearly increasing path on the other hand provides for a path that matures the RA function with changing technology & business ecosystem while enabling various functions and driving the organization towards a data driven one.

Digitalization has greatly expanded overall risks for telcos and in today’s reality of multi-service, multi-disciplinary offerings (eg. Banking, Retail, Digital Content etc), Revenue Assurance function need to move from just assuring revenues (with a primary business focus on EBITDA) to assuring business models, expanding focus beyond revenue management to Business Assurance.

On-Demand Webinar- Managing Business Risks: The Growth of Business Assurance