Mobile Money – Are your customers secure?

KARIBU !!!

‘ M-Pesa’ has been leading the revolution of mobile wallets across the globe. Over 50% of the adult population in Kenya today use M-Pesa service to send money to far-flung relatives, to pay for shopping, utility bills or taxi ride home. While East Africa has been dominating the numbers in the past few years other regions including APAC, EMEA, Europe and Americas are about to explode sooner or later with their own models – NFC, Google Wallets, Mwallets, Apple Passbook,etc

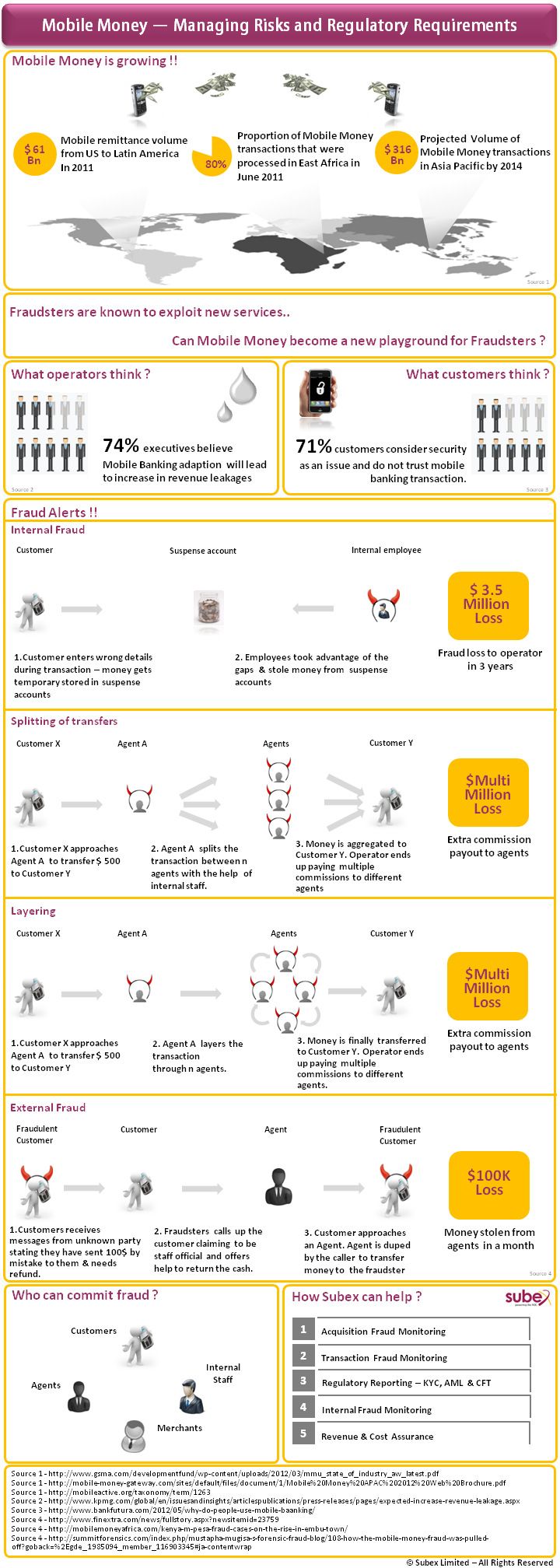

More operators are walking down the path of offering Mobile Banking services in some form or the other every year. These players might get caught off-guard & face what a leading operator in Uganda recent got hit with– a million dollar mobile money fraud loss !! News articles indicate that a recent internal fraud in a leading operator in Uganda lead to 3.5 Million Dollar loss, Mobile Money boss losing his job & 8 other employees getting fired. Operator also received reprimands from the regulator and had significant dent to its brand image. This mess also opened up competition for other players in the country. Regaining confidence of customers and regulators will not be an easy job for such operators. They will be looking to enhance security within their mobile money offerings. It might be a differentiator and lead to uplift in adoption.

This incedence clearly presents a learning for other operators about to offer Mobile Money services. Moving forward, one of the key areas of focus for operators will be to provide a secure mobile money platform to users and manage frauds beyond the traditional regulatory requirements. Below infographic highlights some variants of Mobile Money frauds already rampant within operations and potential damage they might cause.