“A lot of people have been talking about how capex is going to come down with SDN and I’ve said, ‘No, it’s going to stay the same for Verizon’ – Fran Shammo, CFO, Verizon. May 2016

This comment right from the head honcho of one of the largest Telcos in US cannot be taken lightly. Despite lot of talk in the industry about SDN / NFV CAPEX reduction benefits, we’re seeing skeptical questions around smooth transition to virtualization. But I will keep SDN /NFV discussion for some other day. Let us focus on the topic – CAPEX spends. Verizon’s CFO has confirmed its CAPEX spend going to stay, despite network virtualization!

The CAPEX focus could be different for different Telcos. For some Telcos like Verizon, their CAPEX spend mainly focused on future technologies, leading the market, greater customer experience etc. For some other Telcos, their budget constraints force them to think hard and do delicate trade-off between strategical “revenue-growth” projects and tactical maintenance projects to keep up with network growth, retain customers, improve quality of experience etc. With this hard balancing at hand, what if Telcos are equipped with smart tools & methodologies that could help in optimizing their on-going CAPEX? But, is such thing exist? I will get there in a moment. Please bear with me.

First, let us go through few industry trends. In our recent study from Gartner, we got few interesting insights.

Here is short summary on the insights:

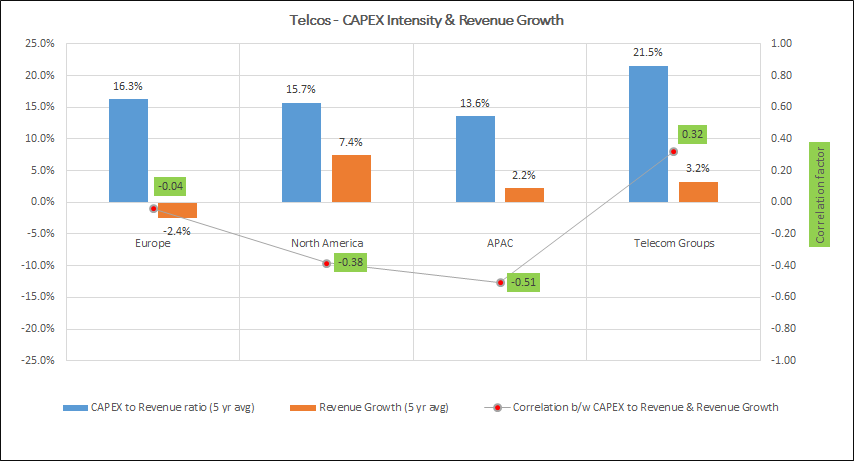

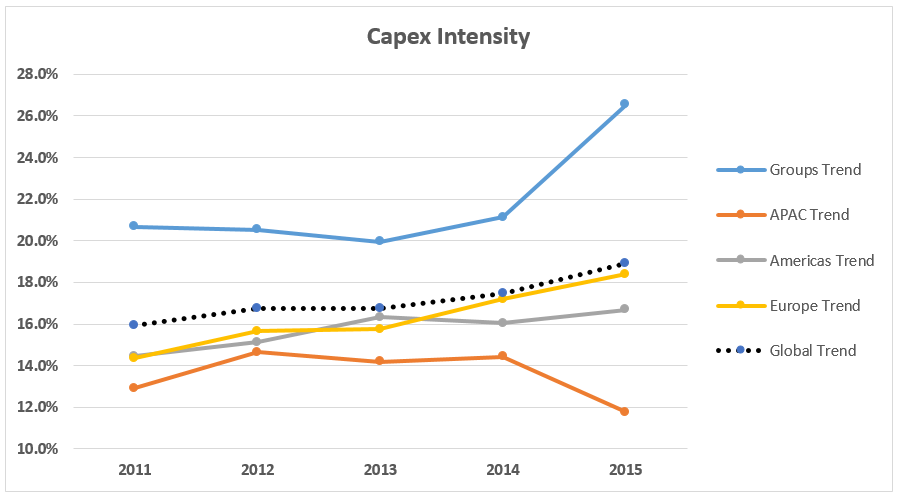

- On an average Telco spends 15% – 20% of annual revenue on yearly Capital Expenditure

- Increase in Capex spends w.r.t revenue (CAPEX Intensity = Capex / Revenue) is not translating into equivalent increase in revenue growth

- Correlation between CAPEX Intensity and Revenue growth is a weak factor for Telcos mentioned in the regions. This means revenue growth is not linearly correlated with CAPEX spends

- 5-year flat growth in revenues across geographies is not encouraging. Max 20% 5-year top-line growth in North America region and deep negative for Europe region (-11%)

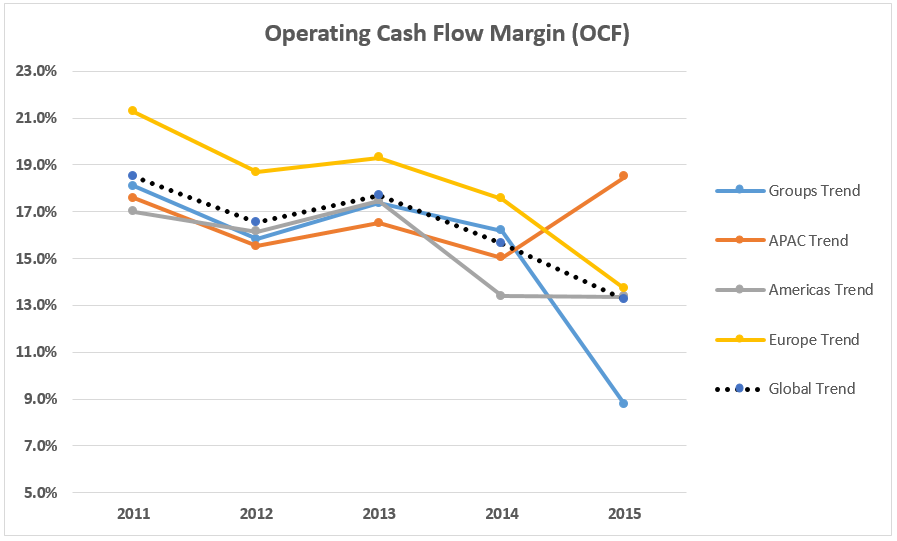

- Cost of capital over last decade is higher than RoI on an average across the industry

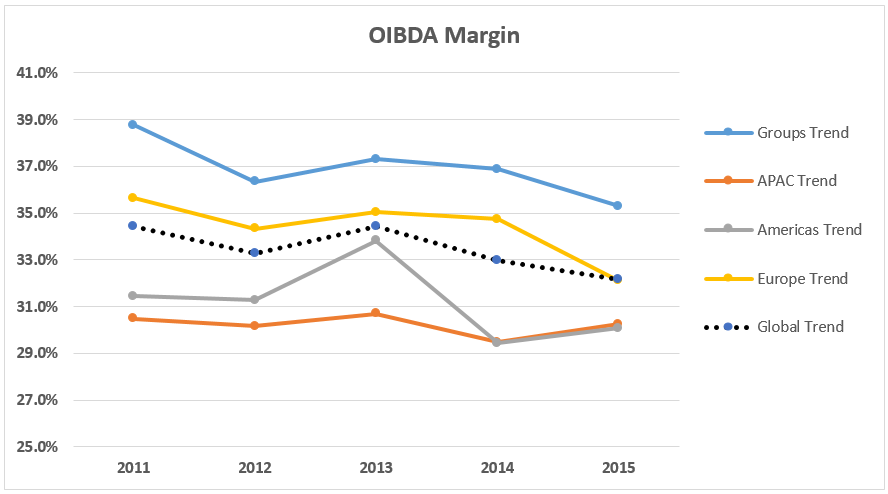

- Notable positive point is the margins are maintained in 25 – 35% range across geographies. And it is imperative to maintain this margins to generate free cash to fund next CAPEX cycle but if not completely.

The above stats where CAPEX spends are not reaping substantial revenue growth indicates two major viewpoints:

- Strategic capital investments have a slightly long gestation period but not comparable to capital cycles of traditional industries like manufacturing industry.

- Bulk of CAPEX go into maintenance projects. That is, to keep-up with current network demand juggernaut, customer retention, quality of service etc.

For instance, a good chunk of leading Tier 1 North American operator’s CAPEX goes into wireless network for densification and getting future ready for 5G deployments. This could be a case for many big Telcos – investing on future technologies. On the contrary, we have also seen majority of Telcos’ CAPEX going in for second type of investment – meeting current network data growth. This is nothing wrong as such and very much required to keep customers happy.

However, if one looks at this fact in light of recent market research findings from one of the big four audit firms, it gives a different perspective. The research reveals that majority of the Telcos not equipped with enough tools or industry best practices to assess the CAPEX spends on projects, evaluate ROI for each such investment and perform sustainable capital allocation. This is a surprising revelation. It simply means that many Telcos are servicing on-going CAPEX without rigorous assessment on actual RoI vs planned RoI, are not taking forward lessons learned from previous CAPEX cycle. Even the Telcos who do have rigorous processes, right incentive structure, accountability of results etc. actually misses a critical point.

What Telcos underestimate?

The critical point is – generally the assets, especially the network assets are viewed from monetary value perspective only in this whole CAPEX scheme of things. The value that can be derived from un-lit or under-used network asset capacities for the CAPEX planned is not given deserved thought or action. This is because of the fundamental reason that financial and network data of assets are lying in silos. This data is never used together to gather useful insights to put the network assets to sweat to furthest possible aligning with ever growing network demand and broader strategic CAPEX – RoI goals. Telcos can do more with their data. It would require collaborative efforts with right partner to unleash the power residing underneath the siloed systems.