Telecom companies across the board often crisscross their blades with OTT players. While it’s true that Telcos are trying to find sustainable new avenues – few are succeeding, their current-state CAPEX keeps growing at an ever faster clip. This is mainly due to exponential data demand from customers resulting in increasing investments into network to keep up quality customer services. With ubiquitous mobile connectivity and video traffic demand spiraling-out, it puts enormous amount of stress on the networks. Telcos need to continue investing in this consumer trend [current-state CAPEX] and at the same time figure out alternative growth areas [growth CAPEX].

To invest in new avenues with better ROIs, Telcos need to keep close tabs on their CAPEX that goes into network for present growing customer demand. And follow the traditional mantra – keep the current cash flow as cushion and invest for future. But for many Telcos, the worrying part is large chunk of the cash flow generated is ploughed back into network to meet current demands. This leaves little room to focus on new growth areas. Telcos are forced to raise money via debt or other means, resulting in further stress on balance sheet and reduced returns to investors.

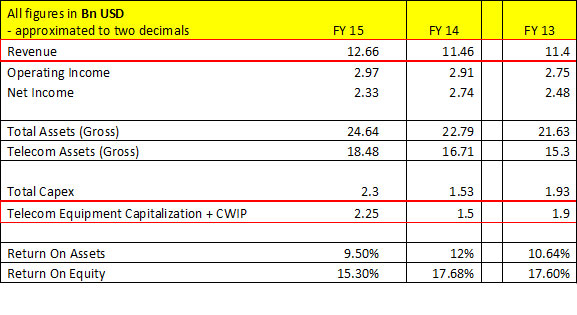

Let’s take a look at a snapshot of financial summary of a public listed global telecom major:

[Figures are normalized]

On a closer inspection of this summary one could observe,

- The CAPEX has increased significantly (50%), but contributed only marginal increase in operating income (2%) and revenues (10%) over a year.

- At the end of three year period, the CAPEX investment grew nearly to 20% of annual revenue but the corresponding incremental revenues seen marginal uptick only.

- Return on Assets came down to single digit despite spending cumulative CAPEX of nearly half of average yearly revenue for this period.

Without undue speculation and with publicly available data, one could do an educated guess: during this period, most of the CAPEX went into supporting & enhancing existing network infrastructure to keep-up quality services.

This picture is not much different from any other typical Telco in the developed or emerging markets. While Telcos try to figure out the next wave of growth, it is equally important to keep a check on the current-state CAPEX.

Telcos have no dearth of information in their siloed systems. It is just that few of these system’s data need to be unleashed to discover insights that can help in reducing CAPEX. For instance, reusing stranded assets in the network, warehouse and spare stores during purchase decisions would reduce CAPEX drastically. This would require deeper analytical insights generation, with collaboration among operation teams within the Telco towards achieving a common goal.

Telecom operators with better equipped analytical tools to gather operational insights and actionable work flows can reduce their on-going CAPEX, draw more mileage from the pan-network assets and derive better return on assets in the network.