- SOLUTIONS

- SERVICES

- ABOUT US

- RESOURCES

- CONTACT

When Efficiency Backfires: A Regulatory Assurance Failure

In January 2025, the South Korean Personal Information Protection Commission (PIPC) fined Apple Pay and KakaoPay a combined ₩8.3 billion (about US$5.8 million) for violating data privacy laws. The fines stemmed from the use of a fraud-prevention scoring algorithm – the NSF score – which transferred sensitive user data to China’s Alipay without user consent or proper regulatory disclosure. Ironically, this tool, intended to prevent financial losses, triggered reputational and regulatory damage of far greater scale.

This event is not just a story about privacy oversight. It is a textbook example of the Efficiency-Thoroughness Trade-Off (ETTO) principle, as introduced by safety professor and researcher Erik Hollnagel. ETTO reminds us those systems, especially under pressure, tend to sacrifice thoroughness for efficiency. What failed here was not only privacy compliance, but a deeper organizational judgment about which risks mattered more.

This case also sets the stage for a broader and more structured response to such failures: the Regulatory Assurance guidebook from TM Forum, a new industry-aligned framework that formalizes the kind of meta-assurance needed to identify and manage systemic trade-offs like the ones seen here.

Understanding the ETTO Principle

According to Hollnagel, organizations and individuals operate under the constraint that they cannot be both efficient and thorough at the same time. When pressed for time, results, or performance, they make trade-offs. Efficiency often wins.

These trade-offs are not inherently wrong. In fact, they are necessary. The danger lies in making them by default. The KakaoPay and Apple Pay case shows what happens when these decisions are made invisibly, without governance.

The Two Layers of Assurance

1. NSF Scores: Operational Assurance

KakaoPay and Apple Pay deployed the NSF (Non-Sufficient Funds) score to predict payment risk. This is a form of operational assurance: using data science to prevent fraud, chargebacks, and transaction failures. It is an efficiency-driven move, intended to protect the business and users alike.

But the algorithm was powered by user data – emails, phone numbers, account balances – transferred daily to Alipay servers in China. No consent was sought. No data protection impact assessment (DPIA) was conducted. No regulatory checks were in place.

2. Privacy Compliance: Regulatory Assurance

In contrast, Regulatory assurance focuses on ensuring that systems operate within legal and ethical boundaries. It requires transparency, accountability, and explicit consent for data processing, especially cross-border.

In this case, the privacy policies were outdated. Users were not informed of data usage. Internal governance did not flag the overseas data transfers. The very act of assuring one type of risk (financial) violated another (regulatory).

How ETTO Caused the Regulatory Breakdown

This is the ETTO principle in motion. Each decision prioritized speed, automation, or predictive power over the slower, more burdensome work of compliance and governance. And each trade-off went undocumented, unacknowledged, and ultimately, unmanaged.

ETTO Is Not a Flaw – But It Must Be Managed

In telecoms, assurance is the operational embodiment of thoroughness. Because sacrificing too much thoroughness results in good efficiency KPIs but it is also a generator for leakages.

Hollnagel never claimed that thoroughness is always better than efficiency. Trade-offs are part of real-world operations. But they must be made consciously, with governance mechanisms that account for what is being sacrificed.

The core failure in the KakaoPay case was not just a privacy error. It was a systems failure: no one paused to ask, “What are we trading away by optimizing for speed and predictive accuracy?”

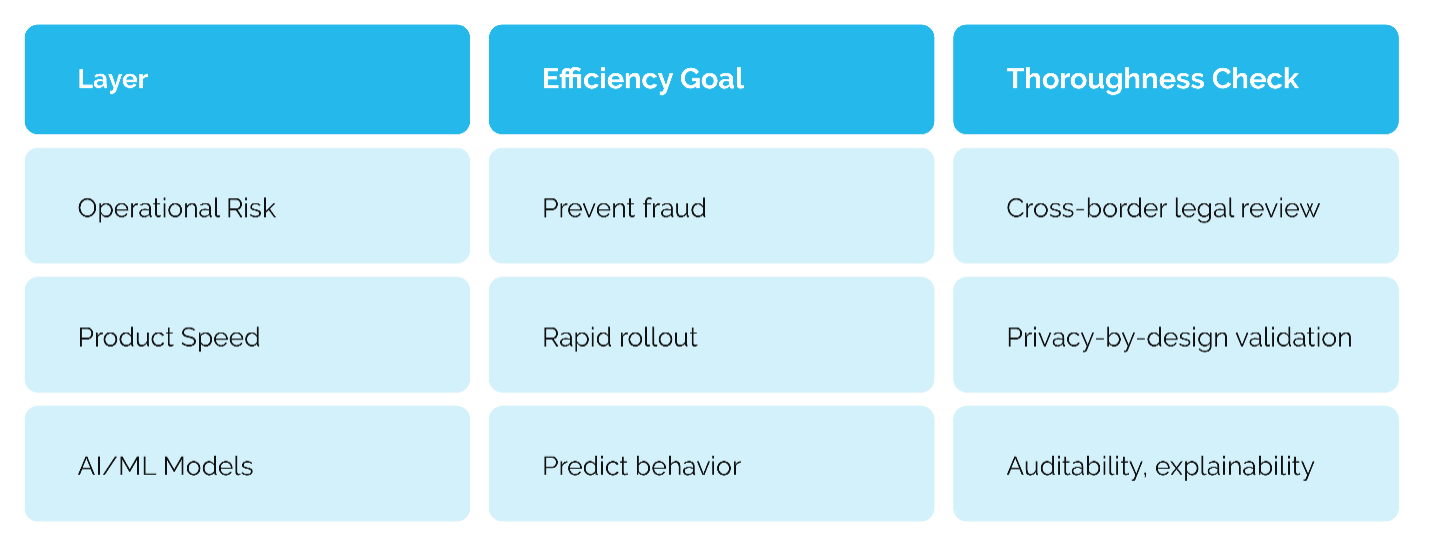

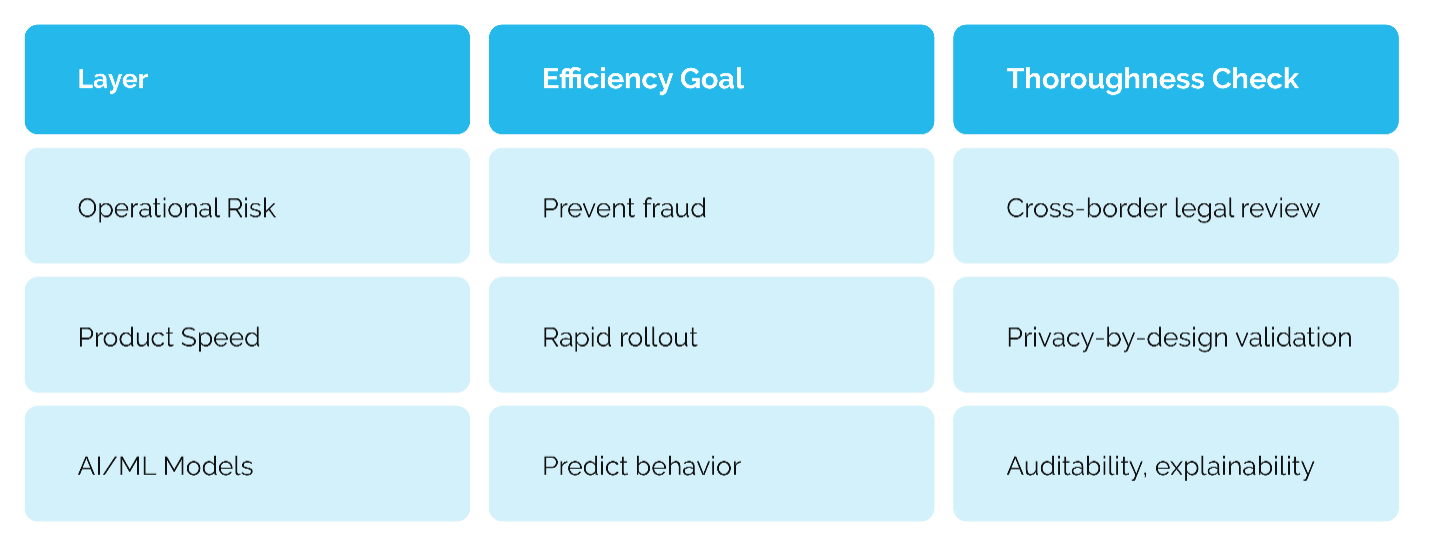

Toward ETTO-Aware Regulatory Assurance

To prevent future failures of this kind, organizations need governance frameworks that make ETTO trade-offs visible and deliberate.

ETTO-Aware Governance Practices:

- Require documentation of trade-offs during project design.

- Mandate risk gates for AI/ML deployment, where both efficiency and compliance must be reviewed.

- Empower compliance and privacy officers with authority to delay deployment.

- Use integrated dashboards that surface both operational and regulatory indicators.

Institutionalize Dual Assurance:

This reframes assurance itself: not as a checkbox or department, but as a system of balance between competing priorities. A system that governs when speed wins, and when it shouldn’t.

This is precisely the kind of institutional perspective proposed in the TM Forum Regulatory Assurance guidebook. The guidebook establishes regulatory assurance as a meta-assurance layer, focused on surfacing and managing tensions between compliance, operations, innovation, and trust. It is designed to help telecom operators and digital service providers ensure that assurance is not siloed, but integrated across the ecosystem.

Conclusion: Design for Conscious Trade-Offs

The lesson from the Apple Pay and KakaoPay fines is not merely that privacy matters. It is that assurance must account for the invisible trade-offs systems make every day.

In a world increasingly driven by AI, automation, and data exchange, these trade-offs will only multiply. True regulatory assurance doesn’t eliminate the ETTO dynamic – it makes it governable.

Don’t wait until fines expose your blind spots. Build systems that ask, early and often: “What are we trading away? And who gets to decide if it’s worth it?”

Glossary

- DPIA: Data Protection Impact Assessment – a systematic process to evaluate the risks to privacy in data processing activities.

- ETTO: Efficiency-Thoroughness Trade-Off – a principle describing how systems tend to sacrifice thoroughness for efficiency under pressure.

- NSF: Non-Sufficient Funds score – a machine learning model used to predict likelihood of payment failure.

- PIPA: Personal Information Protection Act – South Korea’s primary data privacy law.

Which side are you on: Efficiency or Thoroughness? Why?