- SOLUTIONS

- SERVICES

- ABOUT US

- RESOURCES

- CONTACT

How AI and Analytics Are Revolutionizing Fraud Detection in Mobile Money

Mobile money has become the financial heartbeat of Africa, transforming how millions of people transact daily. But with rapid adoption comes rising risk-Mobile Money Fraud is becoming more sophisticated, targeting customers, agents, and providers alike.

As transaction volumes surge and digital inclusion deepens, the need for proactive, real-time, and intelligent fraud prevention has never been more urgent. Legacy rule-based systems are no longer enough. What African mobile money leaders now need is a shift toward AI-powered fraud prevention-one that blends AI in fraud detection with deep analytics, graph intelligence, and near real-time orchestration.

What Are the Types of Mobile Money Fraud?

Understanding fraud types is key to effective prevention. The most common types of telecom mobile money fraud seen across Africa include:

- Identity theft and impersonation: Fraudsters use fake or stolen IDs to access customer wallets.

- SIM-swap attacks: Criminals gain control over users’ phone numbers to hijack accounts.

- Commission fraud by super-agents: Super-agents inflate commissions by cycling funds, creating ghost accounts, or splitting transactions.

- SIM farms: Large-scale use of multiple SIM cards to abuse offers, evade controls, and execute coordinated fraud schemes.

- Social engineering: Victims are tricked into sharing sensitive information like PINs and OTPs.

- Agent and merchant collusion: Fraud rings exploit loopholes in agent or merchant behaviour to manipulate cash flows.

- Transaction laundering: P2P payments masked as merchant transactions to bypass rules.

- Insider threats: Fraud committed or aided by employees with system access.

- Synthetic identities: Fraudsters create fake user profiles to execute multiple small-value scams.

These tactics are increasingly subtle, coordinated, and executed across channels-making real-time detection a necessity.

Mobile Money Fraud Examples

Here are some real-world mobile money fraud examples:

- A user receives a call pretending to be customer care, prompting them to “verify their wallet”-a ploy to extract their PIN and empty their account.

- A group of agents consistently processes unusually high-value cash-outs during off-peak hours-signalling possible collusion.

- Multiple users with different IDs but the same device IMEI conduct repeated low-value transfers-classic mule behaviour.

- A merchant performs thousands of low-value cash-ins, only to cash out through a network of linked wallets-indicating possible laundering.

- An account shows a sudden change in location and device during login-a red flag for potential SIM-swap fraud.

Each of these signals may go unnoticed by static rules, but not by AI in fraud detection, which can flag micro-patterns, relationships, and behavioural anomalies in real time.

How to Prevent Mobile Money Frauds?

For mobile money providers to stay ahead of evolving fraud schemes, the strategy must go beyond detection to prevention and orchestration. Here’s how to achieve effective mobile payment fraud prevention:

- Unify data across all sources: Wallet data, device metadata, KYC, agent behaviour, and transaction history should be brought together for a 360° risk view.

- Invest in real-time analytics: Delay-based systems are no longer viable. You need fraud detection that happens in milliseconds.

- Use network-level insights: Graph models help identify fraud rings operating across thousands of accounts and devices.

- Implement graded interventions: Rather than blocking transactions blindly, use risk-based scoring to apply friction only where necessary.

- Empower your fraud teams: Equip investigators with AI-assisted dashboards that suggest actions, highlight linked fraud, and learn from every decision.

- Build explainability and governance: Regulators expect transparency. AI outputs must be auditable, interpretable, and compliant with risk-based AML/CFT guidelines.

How Are AI and Analytics Used in Mobile Money Fraud Detection?

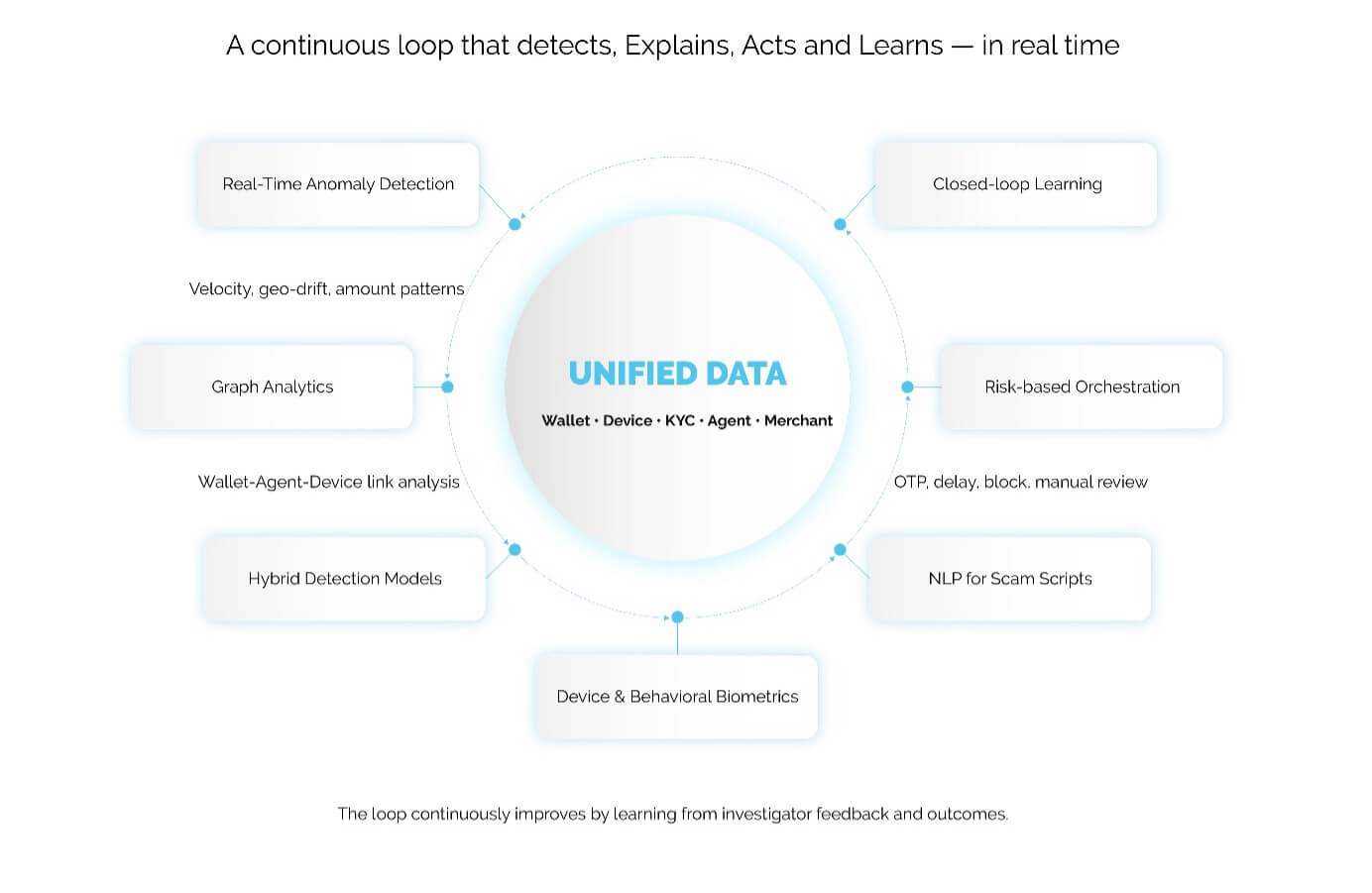

AI and analytics are now central to modern fraud detection in mobile money. Here’s how they’re transforming the fight against fraud:

1. Real-Time Anomaly Detection

AI models can process massive transaction data in real time-flagging deviations in velocity, location, device use, and transaction value. This enables early detection before fraudulent transactions are settled.

2. Graph Analytics

Fraud rarely happens in isolation. Graph-based analytics map relationships across users, devices, SIMs, agents, and merchants-uncovering hidden fraud rings and collusion networks.

3. Hybrid Detection Models

A layered approach: combining business rules (for known fraud types), supervised learning (where historical fraud data exists), and unsupervised models (to detect new and evolving fraud patterns).

4. Device Intelligence and Behavioural Biometrics

By analysing how users interact with mobile apps or USSD interfaces, AI can differentiate between genuine users and fraudsters-even when credentials are compromised.

5. Natural Language Processing (NLP)

NLP and large language models (LLMs) scan support tickets, dispute notes, and chat logs to identify new scam scripts and fraudulent patterns as they emerge.

6. Risk-Based Orchestration

AI assigns dynamic risk scores to each transaction or user. Based on this score, the system can automatically apply the right level of intervention-like an OTP prompt, delay, or block.

7. Closed-Loop Learning

Investigator feedback is fed back into the system, enabling continuous learning. Over time, false positives are reduced, and model accuracy improves.

Subex’s AI-Powered Approach: Enabling CSPs in Africa to Combat Fraud and Drive Business Assurance

With over two decades of expertise in telecom risk and assurance, Subex empowers Communication Service Providers (CSPs) globally to fight fraud, safeguard revenues, and enhance customer experience with precision and scale.

Here’s how Subex is addressing today’s challenges with AI and GenAI:

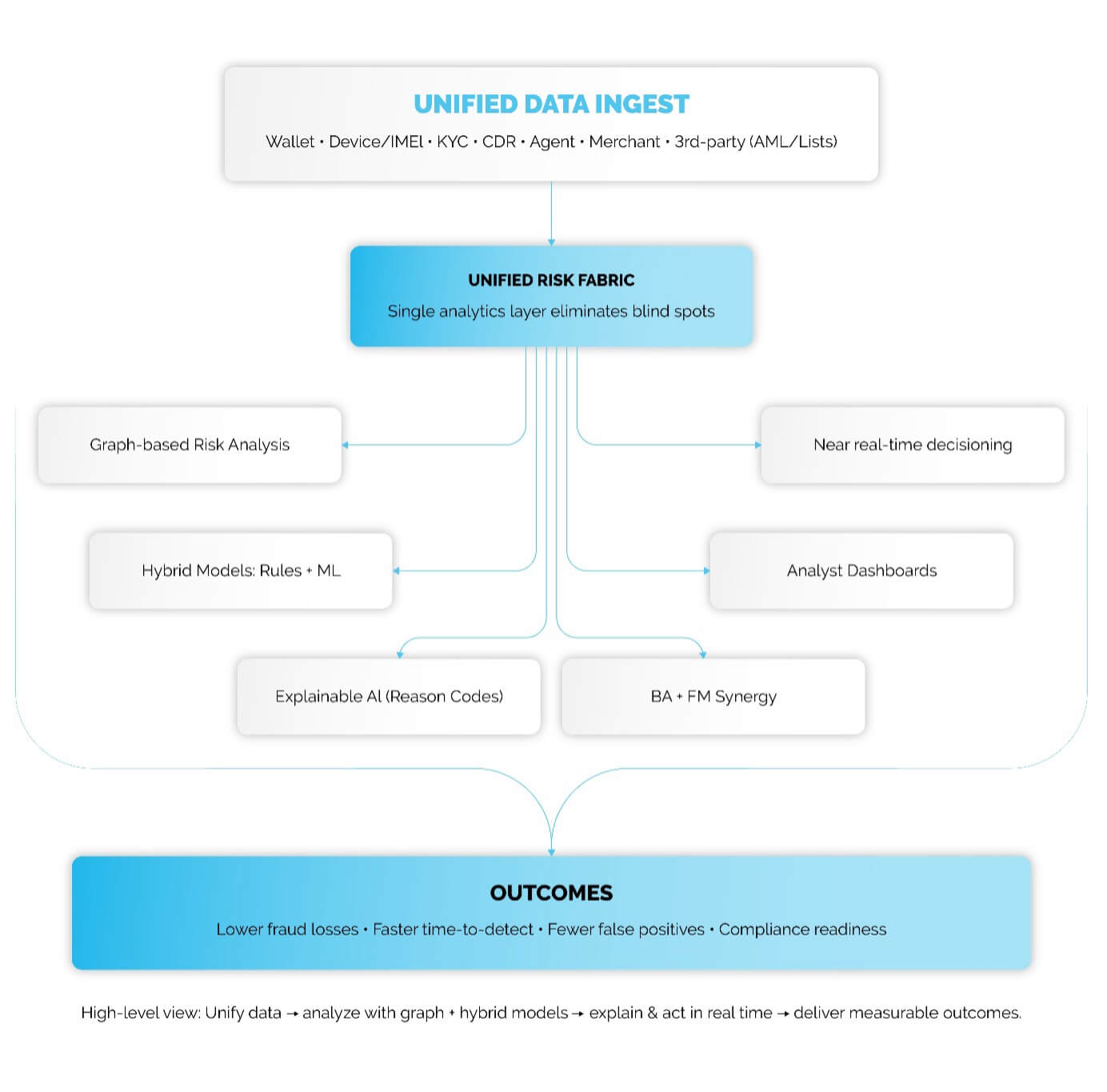

- Unified Risk Fabric: Subex integrates diverse data sources-subscriber, device, network, KYC, billing, merchant, and partner data-into a single analytics layer, removing blind spots and enabling holistic risk assessment.

- Graph-Based Risk Analysis: Fraud and revenue leakages rarely occur in isolation. Subex maps relationships across users, SIMs, devices, agents, and partners to uncover fraud rings, collusion networks, and anomalous behaviours.

- Explainable AI: Our hybrid detection models (rules + AI + GenAI) provide clear reason codes, risk scores, and transparency, ensuring both analysts and regulators can interpret and trust decisions.

- Near Real-Time Decisioning: Subex enables proactive intervention by detecting anomalies and leakages as they happen-preventing revenue loss and minimizing customer impact.

- AI-Powered Agents and Workflows: GenAI-powered investigation agents accelerate fraud and revenue assurance case closures, automate reporting, and free up analysts to focus on higher-value tasks like researching new fraud methods and emerging risks.

- Operational Dashboards: Subex equips fraud and assurance teams with intuitive dashboards, AI-assisted workflows, and feedback loops-reducing investigation time, improving detection rates, and enhancing productivity.

- Business Assurance + Fraud Management Synergy: Beyond fraud detection, Subex helps operators identify revenue leakages, optimize product portfolios, enhance customer lifetime value, and assure compliance with business KPIs.

How an African Operator Saved Over $3M with Subex Fraud Detection

A leading African mobile money operator was facing unexplained leakages. Fraudulent transactions disguised as legitimate cash-ins were bypassing traditional controls. Manual investigations proved inefficient, and fraud continued to erode revenue.

Subex deployed fraud detection system that:

- Automatically identified misclassified P2P transfers.

- Flagged fraud rings operating across agents and wallets.

- Quantified and reported daily losses in real-time.

The result? Over USD 3 million saved annually and a dramatic reduction in fraud volume and detection time. [Download the full case study]

Final Thoughts

In Africa, mobile money is more than just a convenience-it’s the foundation of financial inclusion. But to protect this foundation, providers must outpace fraudsters using modern tools.

AI in fraud detection is no longer optional. It’s a strategic necessity.

Subex offers telecom operators the tools they need to fight fraud intelligently-through AI, real-time analytics, and telecom-grade precision. If you’re serious about revenue protection, customer trust, and regulatory compliance, the time to modernize your fraud defences is now.

Protect your mobile money business from fraud-while enhancing trust, speed, and compliance.